Explore the Intricacies of Bankruptcy Services and How They Can Supply the Assistance You Need

When financial obstacles impend big, seeking the aid of bankruptcy solutions ends up being vital in locating a method forward. In exploring the different facets of bankruptcy services and the advantages they bring, a more clear path to monetary stability and recovery arises.

Understanding Insolvency Providers

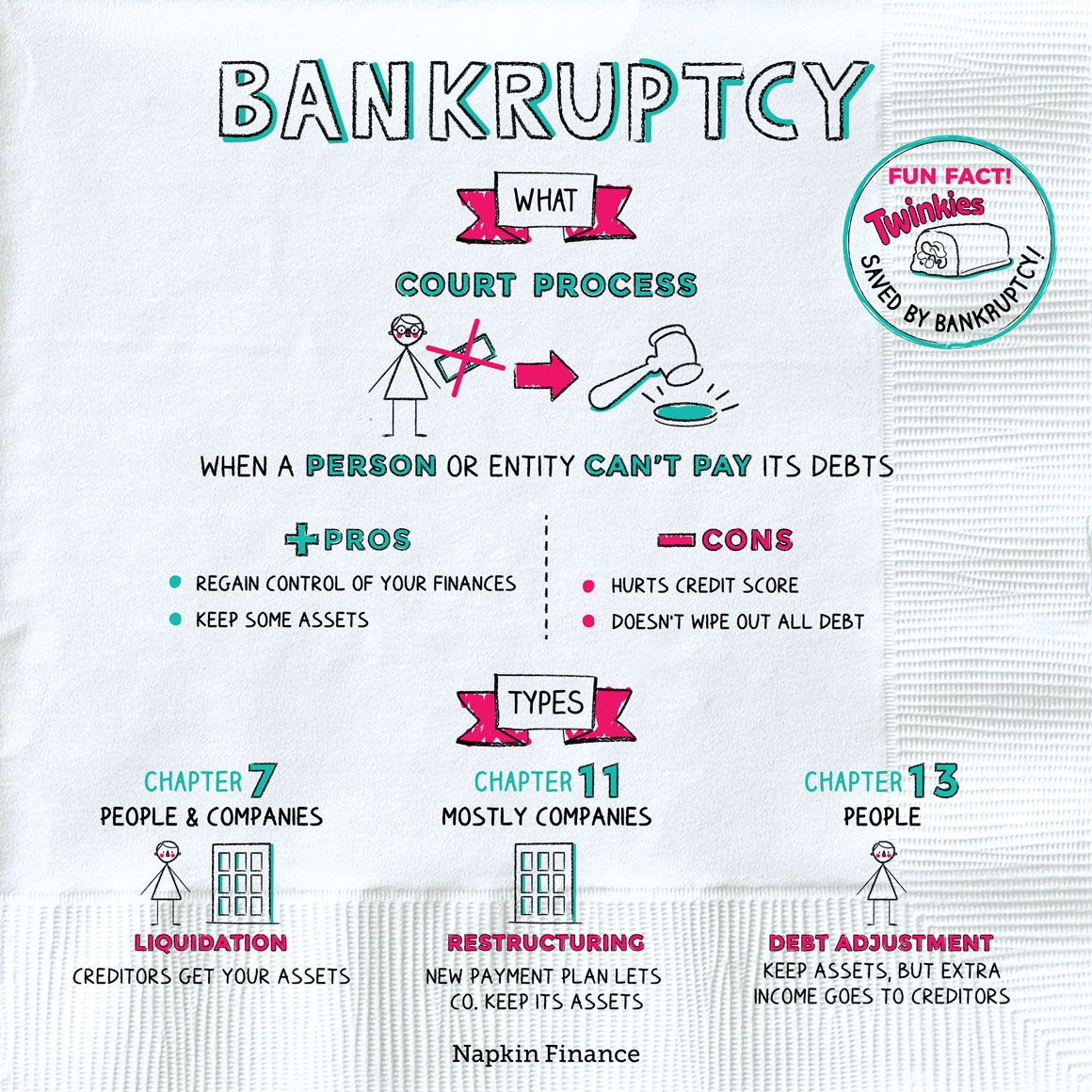

One secret aspect of recognizing insolvency services is identifying the different insolvency treatments available under the regulation. For individuals, choices such as individual volunteer arrangements (Individual voluntary agreements) or insolvency might be taken into consideration, while organizations may explore business volunteer plans (CVAs) or management. Each option includes its own collection of requirements, ramifications, and possible results, making it vital to seek specialist assistance to make enlightened decisions.

In addition, insolvency experts can offer valuable advice on taking care of lenders, negotiating settlements, and restructuring financial debts to achieve economic security. By understanding insolvency solutions and the support they offer, companies and people can browse challenging monetary circumstances with confidence and clearness.

Sorts Of Bankruptcy Solutions

What are the distinctive types of bankruptcy remedies readily available to people and organizations in economic distress? When encountered with bankruptcy, there are numerous paths that individuals and businesses can take to address their economic challenges.

One more insolvency solution is an Individual Volunteer Setup (IVA), a formal arrangement in between a private and their creditors to repay financial obligations over a particular duration. Individual voluntary agreements provide a structured means to handle financial obligation while avoiding personal bankruptcy.

For organizations, administration is a type of bankruptcy option that entails assigning a manager to supervise the firm's affairs and job in the direction of a recuperation or orderly winding up of the organization. This can help businesses in economic distress restructure and potentially stay clear of closure. Each of these insolvency remedies uses a various technique to resolving monetary difficulties, providing to the unique requirements of businesses and people dealing with insolvency.

Benefits of Looking For Specialist Assistance

Seeking professional aid when navigating insolvency can supply people and companies with expert advice and strategic options to successfully manage their financial challenges. Insolvency professionals bring a riches of experience and knowledge to the table, using tailored suggestions based upon the certain circumstances of each case. By enlisting the services of bankruptcy experts, clients can take advantage of an organized approach to solving their financial problems, ensuring that all readily available choices are discovered and one of the most sensible option is sought.

Additionally, professional bankruptcy experts have a deep understanding of the governing and legal frameworks bordering bankruptcy proceedings. This competence can be very useful in guaranteeing compliance with pertinent laws and policies, lessening the threat of costly mistakes or oversights during the bankruptcy procedure.

Additionally, involving professional assistance can assist relieve the tension and worry connected with insolvency, allowing organizations and people to concentrate on reconstructing their monetary health and wellness (Business Insolvency Company). The assistance and support given by bankruptcy specialists can instill self-confidence and quality in decision-making, encouraging customers to browse the complexities of insolvency with greater simplicity and effectiveness

Value of Timely Treatment

Having actually acknowledged the benefits of Read More Here expert support in taking care of financial obstacles throughout insolvency, it ends up being essential to underscore the essential relevance of prompt intervention in such situations. Timely treatment plays an essential role in mitigating further economic damage and making the most of the chances of effective restructuring or healing. When facing bankruptcy, delays in seeking help can worsen the circumstance, leading to increased financial debts, legal difficulties, and prospective liquidation. By acting quickly and involving insolvency solutions at the earliest indications of economic distress, people and companies can access customized services to resolve their particular requirements and navigate the find here intricacies of bankruptcy proceedings a lot more efficiently.

Prompt treatment demonstrates a commitment to addressing financial challenges responsibly and morally, instilling self-confidence in stakeholders and promoting count on in the insolvency procedure. In final thought, the value of prompt treatment in insolvency can not be overstated, as it offers as a crucial variable in figuring out the success of monetary healing efforts.

Browsing Bankruptcy Procedures

Efficient navigating with insolvency treatments is vital for individuals and companies dealing with economic distress. The initial action in browsing bankruptcy treatments is typically examining the economic scenario and determining the most appropriate course of action.

Engaging with insolvency experts, such as licensed bankruptcy experts, can provide valuable guidance throughout the process. These professionals have the competence to assist navigate complicated legal requirements, connect with financial institutions, and create restructuring strategies to resolve financial troubles properly. Furthermore, seeking early advice and treatment can help mitigate risks and boost the probability of a successful outcome. By understanding and properly browsing bankruptcy treatments, individuals and companies can work towards solving their monetary obstacles and attaining a clean slate.

Conclusion

By looking for specialist aid, people and organizations can browse bankruptcy procedures efficiently and check out various remedies to resolve their economic obstacles. Recognizing the details of bankruptcy services can help individuals make informed choices and take control of their economic wellness.

One secret element of comprehending insolvency solutions is identifying the various insolvency treatments readily available under the regulation. Each of these bankruptcy services offers a various method to settling economic problems, catering to the one-of-a-kind requirements of individuals and companies encountering insolvency.

Engaging with bankruptcy professionals, such as licensed bankruptcy professionals, can provide beneficial support throughout the procedure.